Resilience of the Indian Smartphone Market: Q4 2023 Highlights

In the ever-evolving landscape of technology, the Indian smartphone market has proven its resilience once again. Counterpoint Research’s latest insights reveal that Q4 2023 witnessed a remarkable 25 percent year-on-year (YoY) growth in smartphone shipments, signaling a substantial rebound after a year-long decline. Let’s delve into the details of this remarkable turnaround and discover the key players that made it happen.

1. Samsung’s Remarkable Lead

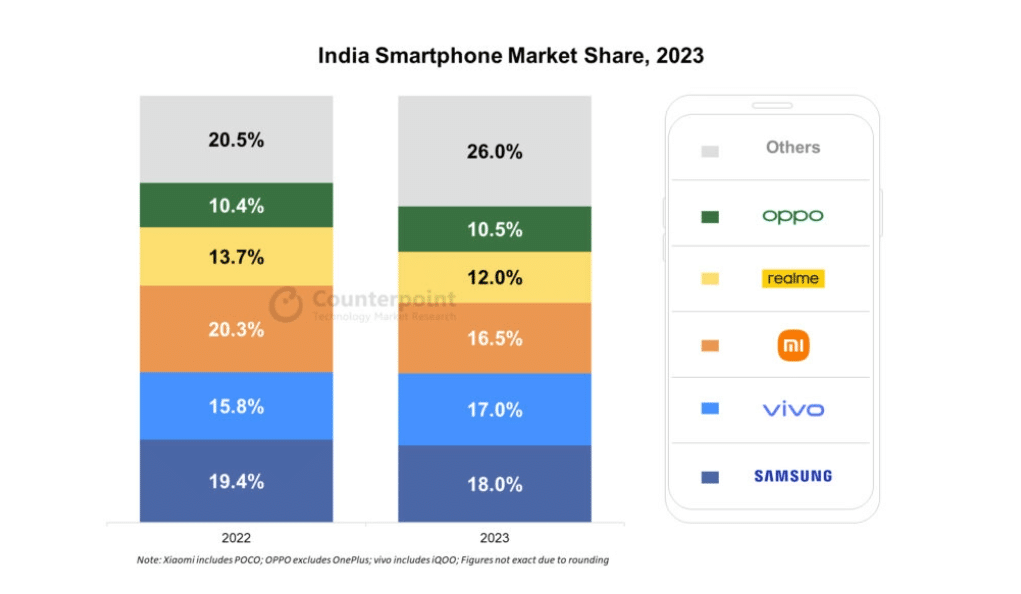

In the year 2023, Samsung emerged as the undisputed leader with an impressive 18 percent market share. This feat was achieved through a combination of factors, including the strong performance of their A-series, aggressive offline marketing campaigns, and a focused approach in the premium segment. Samsung’s strategic moves paid off, securing its position at the top of the Indian smartphone market.

2. Vivo’s Affordable Premium Dominance

Vivo secured the second position with a 17 percent market share in 2023. Their success was attributed to the Vivo V29 series in offline markets and the T-series in online platforms. Vivo’s emphasis on the affordable premium segment struck a chord with Indian consumers, helping them secure a strong foothold in the market.

3. Xiaomi’s YoY Shift

Xiaomi, while slipping to the third spot for the year 2023, made a remarkable comeback in Q4 2023. Their resurgence was fueled by the strategic launch of 5G phones in the affordable segment, expansion into offline markets, and a streamlined product portfolio. This dynamic approach allowed Xiaomi to regain its competitive edge.

4. Significant Growth by Challenger Brands

Several challenger brands, including OnePlus, Google, Lava, Motorola, and Transsion, made significant strides in 2023. Their innovative offerings and consumer-centric strategies contributed to a more diverse and competitive smartphone market.

5. The Rise of 5G

One of the most significant trends of 2023 was the focus on bringing 5G technology to the lower market segments. This initiative resulted in a remarkable 66 percent growth, with 5G phone shipments accounting for over 52 percent of the market. The accessibility of 5G technology is reshaping the way Indian consumers experience mobile connectivity.

6. Positive Inventory Trends

The last quarter of 2023 left the market with healthier inventory levels compared to the previous year. This sets a positive tone for growth in the coming year, with Counterpoint Research predicting a 5 percent YoY market growth in the near future.

7. The Premium Segment’s Growth

The premium smartphone segment experienced an astonishing 64 percent YoY growth in 2023, primarily driven by easy financing schemes. This allowed consumers to upgrade to higher-priced phones, with one out of every three smartphones being purchased through financing. The demand for premium devices continues to rise, reshaping the market landscape.

8. Apple’s Remarkable Milestone

Apple’s dedicated focus on the Indian market bore fruit in 2023. The brand surpassed the 10 million unit mark in shipments and secured the top position in revenue for the first time in a calendar year. This achievement was propelled by the demand for both the latest and older iPhone models. Apple’s retail expansion and strategic promotions also played a crucial role in increasing offline shipments.

9. The Dominance of Offline Channels

Offline channels gained significant ground in 2023, accounting for 55 percent of the market share. Consumers’ preference for a hands-on experience with devices drove this trend. With increased trade-in options and financing choices, this preference is expected to continue in 2024.

10. The Rise of Foldable Smartphones

The foldable smartphone segment is poised for growth in the premium market, with shipments expected to exceed 1 million units in 2024. This exciting development reflects the ever-changing preferences of Indian consumers.

In conclusion, the Indian smartphone market displayed remarkable resilience and growth in Q4 2023. The collaborative efforts of leading brands, the advent of 5G technology, and consumer-focused strategies all contributed to this positive momentum. As we look ahead to 2024, the smartphone landscape in India promises to be dynamic and filled with exciting opportunities.

Big Sale Amazon”

Amazon Sale, Discounted Deals & Offers Alert

and Get Upto 90% Discount on All products

Join Us Today

FAQs

- How did Samsung secure its leadership position in 2023?Samsung achieved its market leadership in 2023 through a strong performance of the A-series, aggressive offline marketing, and a focused approach in the premium segment.

- What contributed to Vivo’s success in the affordable premium segment?Vivo’s success in the affordable premium segment can be attributed to the Vivo V29 series in offline markets and the T-series in online platforms.

- How did Xiaomi make a comeback in Q4 2023?Xiaomi’s resurgence in Q4 2023 was driven by the strategic launch of 5G phones in the affordable segment, expansion into offline markets, and a streamlined product portfolio.

- What were the key trends in the Indian smartphone market in 2023?Key trends in 2023 included the rise of 5G technology, positive inventory trends, growth in the premium segment, and the dominance of offline channels.

- What is the outlook for foldable smartphones in India in 2024?The foldable smartphone segment is expected to gain popularity in the premium segment, with shipments predicted to exceed 1 million units in 2024.